Financial Risk Management: Safeguarding Your Financial Future

- Home

- Case Study

- Financial Risk Management: Safeguarding Your Financial Future

Financial risk management is the cornerstone of financial stability for individuals and businesses alike. It's the process of identifying, analyzing, and mitigating potential financial losses arising from various uncertainties. By proactively managing risk, you can make informed financial decisions, protect your assets, and achieve your long-term financial goals.

Types of Financial Risks

There are several key types of financial risks to consider:

Market Risk: Fluctuations in stock prices, interest rates, and foreign exchange rates can impact your investments and overall financial well-being.

Credit Risk: The risk of borrowers defaulting on loans, potentially leading to financial losses for lenders.

Liquidity Risk: The inability to easily convert assets into cash when needed, potentially causing financial strain.

Operational Risk: Losses arising from internal inefficiencies, human error, or technological failures within a business.

Credit Card Debt: Uncontrolled credit card usage and high-interest rates can lead to a significant financial burden.

Strategies for Effective Risk Management

Here are some key strategies you can employ to manage financial risk:

Diversification: Spread your investments across different asset classes (stocks, bonds, real estate) to minimize the impact of market downturns in any single asset class.

Emergency Fund: Build an emergency fund to cover unexpected expenses or income disruptions, helping you weather financial storms.

Insurance: Utilize insurance products like health, life, and property insurance to protect yourself from unforeseen events that could cause financial hardship.

Budgeting and Cash Flow Management: Create a budget and track your income and expenses to maintain control over your finances and avoid overspending.

Debt Management: Develop a plan to repay outstanding debt, prioritizing high-interest debts first, and avoid taking on excessive new debt.

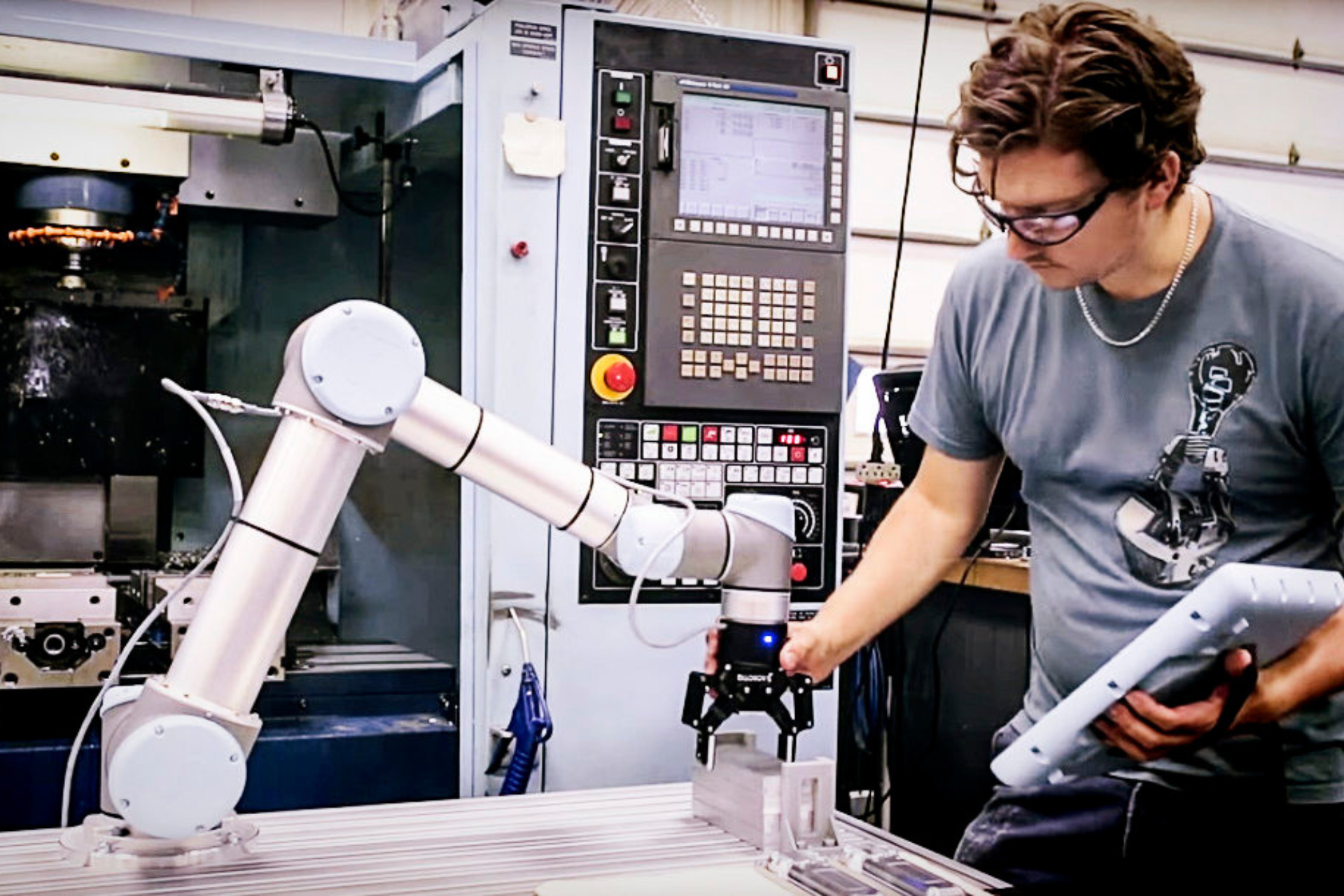

The Role of Machine Learning in Financial Risk Management

Financial institutions and businesses are increasingly leveraging machine learning (ML) to enhance their risk management practices. Here's where Paysenz comes in. We are actively researching and developing cutting-edge ML-powered solutions to:

Identify Emerging Risks: Our ML algorithms analyze vast amounts of financial data to uncover hidden patterns and predict potential risks that traditional methods might miss. This can empower you to take proactive measures to mitigate these risks.

Credit Risk Assessment: Paysenz is researching methods to develop more accurate credit scoring models. This can benefit both lenders and borrowers by enabling lenders to make informed lending decisions and borrowers to potentially qualify for better loan terms.

Fraud Detection: We are exploring the potential of ML for real-time fraud detection, protecting financial institutions and consumers from financial losses.

Beyond Research: Paysenz Risk Management Solutions (Available Now)

While we continue our research on the leading edge of ML for risk management, Paysenz currently offers a variety of tools and services to help you manage your financial risks:

Automated Financial Data Aggregation: Gain a comprehensive overview of your finances by connecting your bank accounts, credit cards, and investment accounts. This allows you to easily track your income, expenses, and investments in one place.

Budgeting and Goal Setting Tools: Set financial goals and create a budget to stay on track. Paysenz can help you monitor your progress and identify areas where you can optimize your spending.

Financial Literacy Resources: We provide educational resources to help you understand financial concepts and make informed decisions about your money.

Benefits of Effective Risk Management with Paysenz

By implementing sound risk management practices with Paysenz, you can reap significant benefits:

Reduced Financial Losses: Proactive risk mitigation minimizes the likelihood and impact of financial setbacks.

Improved Financial Stability: Managing risk fosters financial security and peace of mind.

Informed Investment Decisions: Risk awareness empowers you to make well-considered financial choices.

Enhanced Business Continuity (for Businesses): Businesses can build resilience against financial disruptions.

Conclusion

Financial risk management is an ongoing process. By understanding the different types of risks, implementing effective strategies with tools from Paysenz (both current and those in development), you can navigate the financial landscape with confidence and achieve your long-term financial goals.